New features in Credit Management.

Dynamics 365 incorporates new features for the operation of credit limit,

• Manage changes using workflows

• Classification of risks and classification groups.

• Credit limit suggested by the system based on risk groups.

• Create workflows for credit limit approval.

• Allow temporary credit limits.

• Link customers for credit limit management across groups.

• Credit limit checks incorporating a grace period.

In this article we will deal with the new blocking rules using Order blocking.

Blocking rules I

Blocking rules leave a sales order on credit hold (blocked). There are different criteria, and in this first post, I would like to emphasize the blocking options by modifying the payment terms, or the settlement discounts.

First of all, the blocking rules can be applied to an individual customer as well as to a group of customers, we have the following rules:

• Number of days past due

• Account status

• Payment conditions

• Overdue credit limit

• Amount overdue

• Sales order amount

• Used portion of available credit

Apart from these 7 rules, , we have two additional options, which will also block sales orders automatically.

• Change in payment terms

• Change in settlement discounts

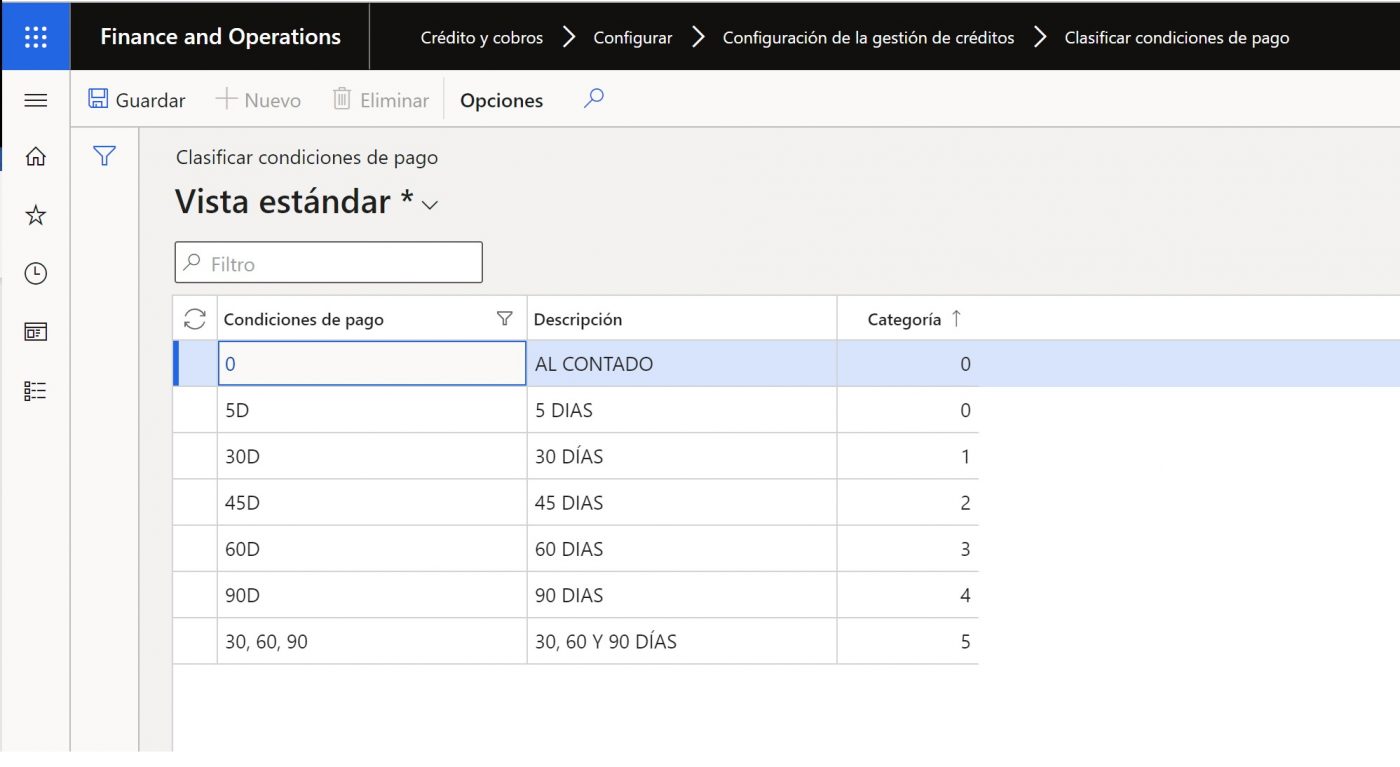

These last two options work in a similar way, the first thing to do is to classify payment terms, settlement discounts, or both in Credit and collection > Setup > Credit management settings > Classify payment terms / Classify settlement discounts.

Classifying payment terms is done by assigning a category, with the lowest being the least risky and the highest the most risky, so to create an example, let’s assume that terms 0 and 5 days are the least risky and the following are increasing.

In the same way the category would work in the settlement discounts.

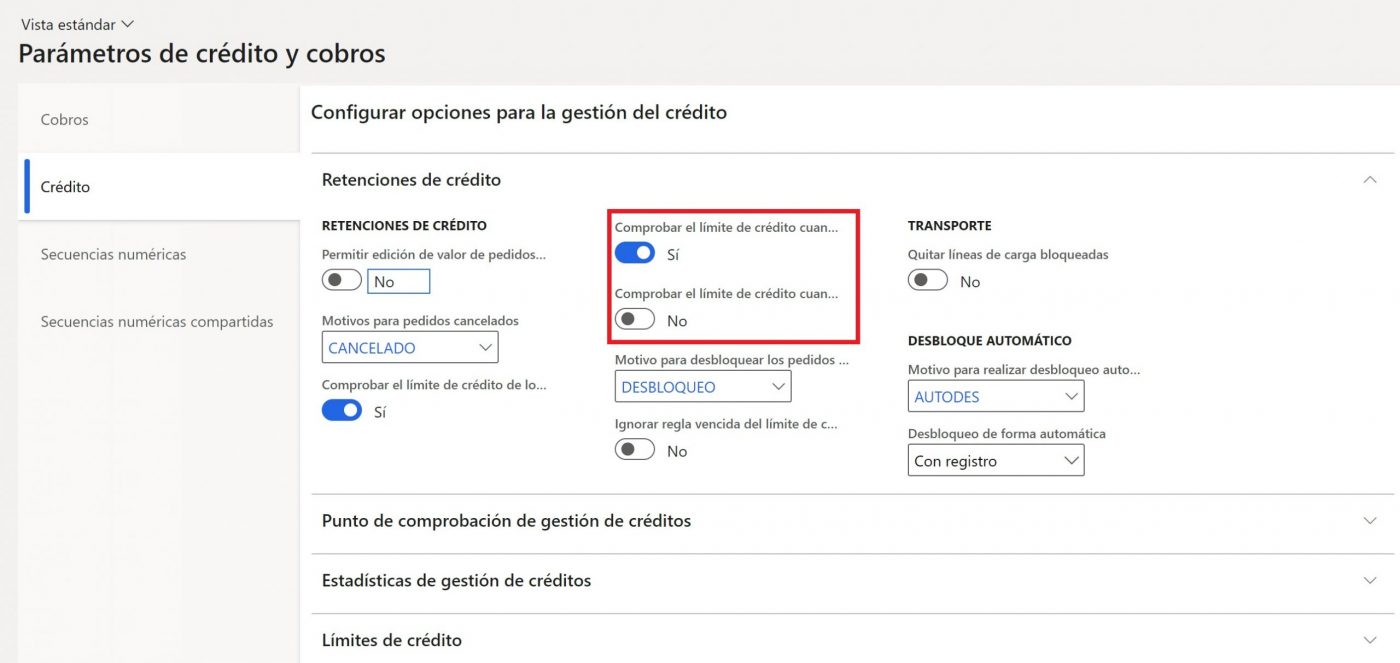

For this to be validated, we have to have checked in the Credit and collection parameters, in “Credit” tab, the check Check risk limit when instalment payments increase, for the validation of payment terms and the check Check credit limit when a settlement discount increases, for settlement discounts.

This will check if the payment condition or cash discount of the sales order is different from the one marked on the customer.

If the new payment terms/discount have a higher classification than the original payment terms/discount, the order is put on hold (blocked) in credit administration.

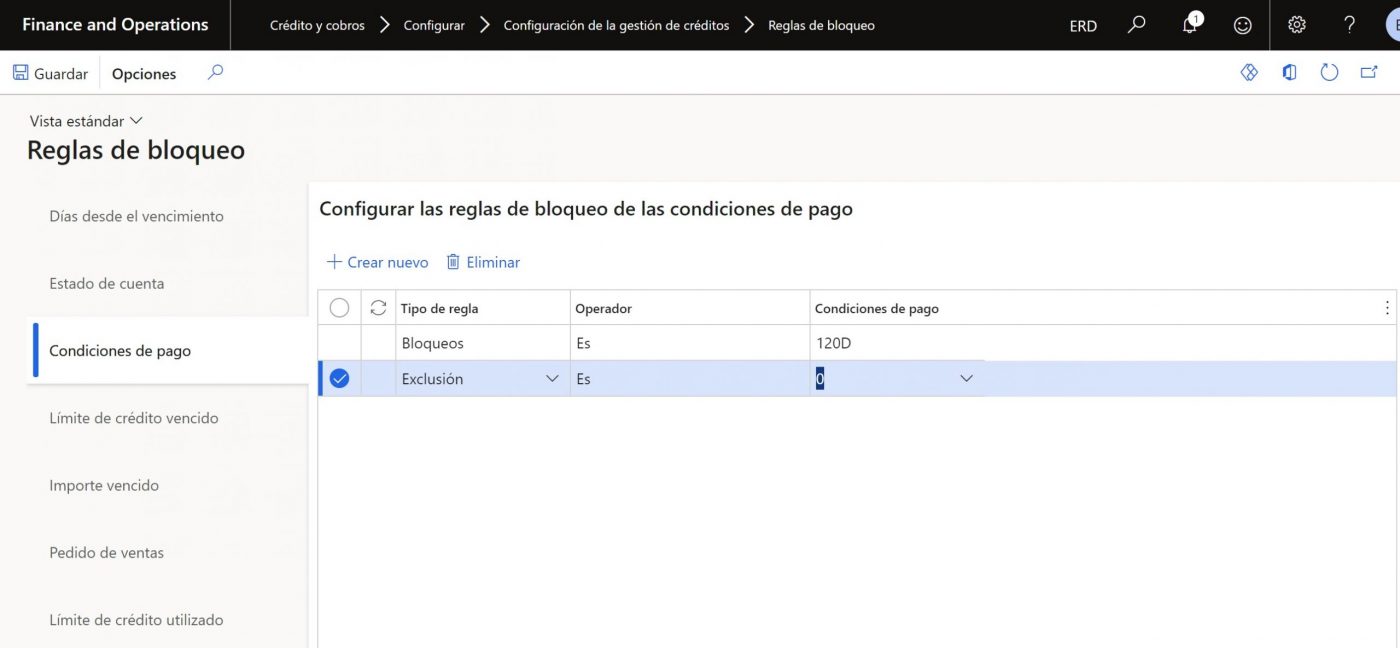

Let’s see with an example, how they would work, let’s assume a customer who pays 30 days, here it is important to take into account one thing, the payment method, as we can have payment methods that are excluded from blocking, for example, a cash payment method, that is one of the exclusion rules, which will be seen in the next chapter, a spoiler, to configure that a form of payment is not taken into account, would be in Credit and Collections > Configure > Credit management management configuration > Blocking rules, in the part of “Payment conditions” you can put excluded payment conditions, depending on the type of rule:

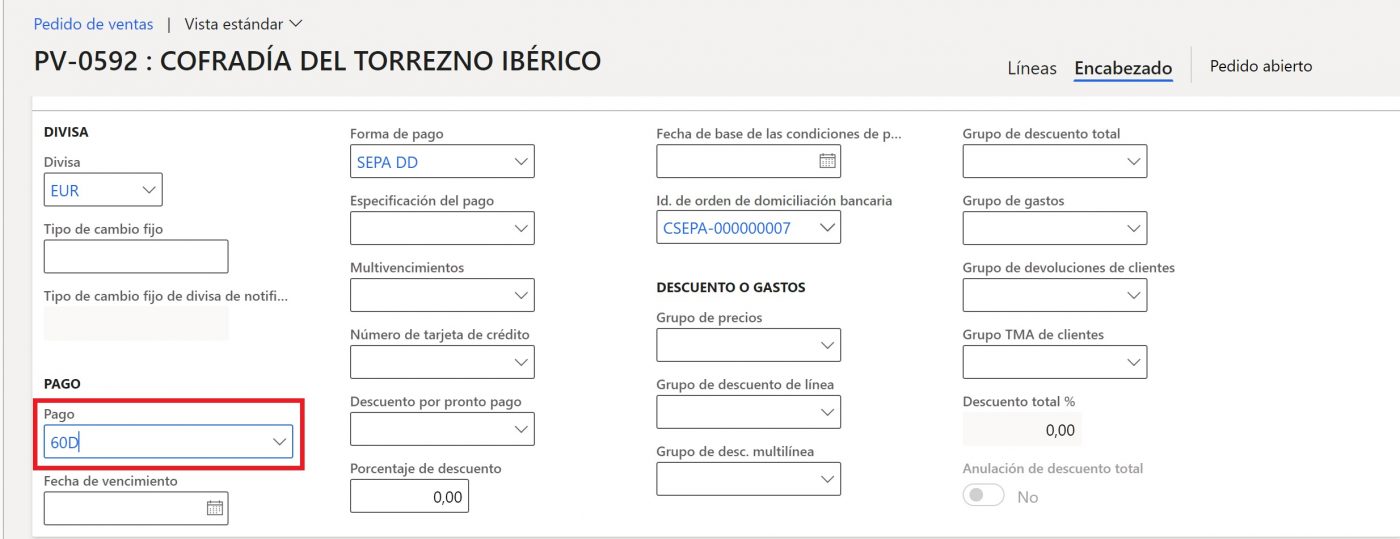

For our example we already have a sales order created and we are going to modify the payment condition from 30D to 60D.

Here you are going to allow me a license, I am from Avila, one of our star dishes are the potatoes revolconas and a fundamental ingredient is the torrezno, hence the name of the client, I apologise to all the people who do not like them.

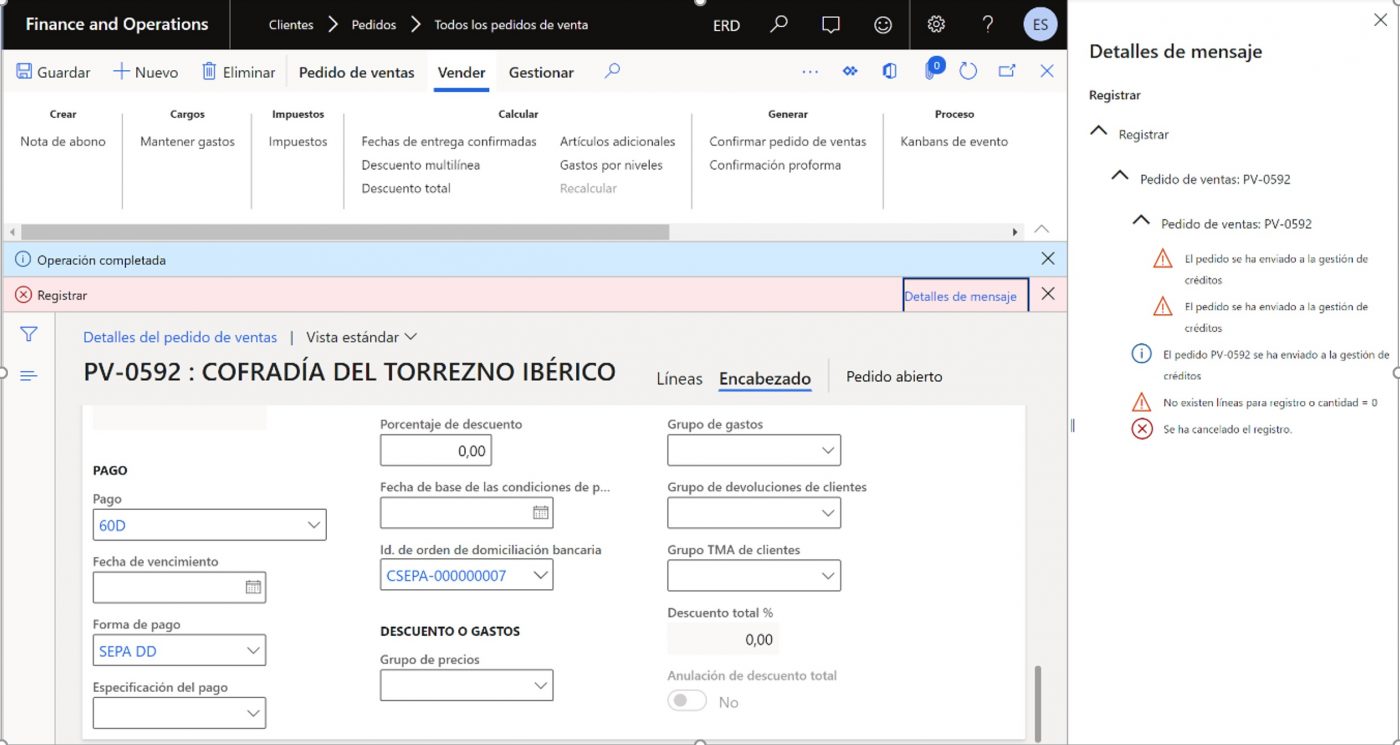

Now the sales order would have to be confirmed, here you would find the modification and send the order to credit management.

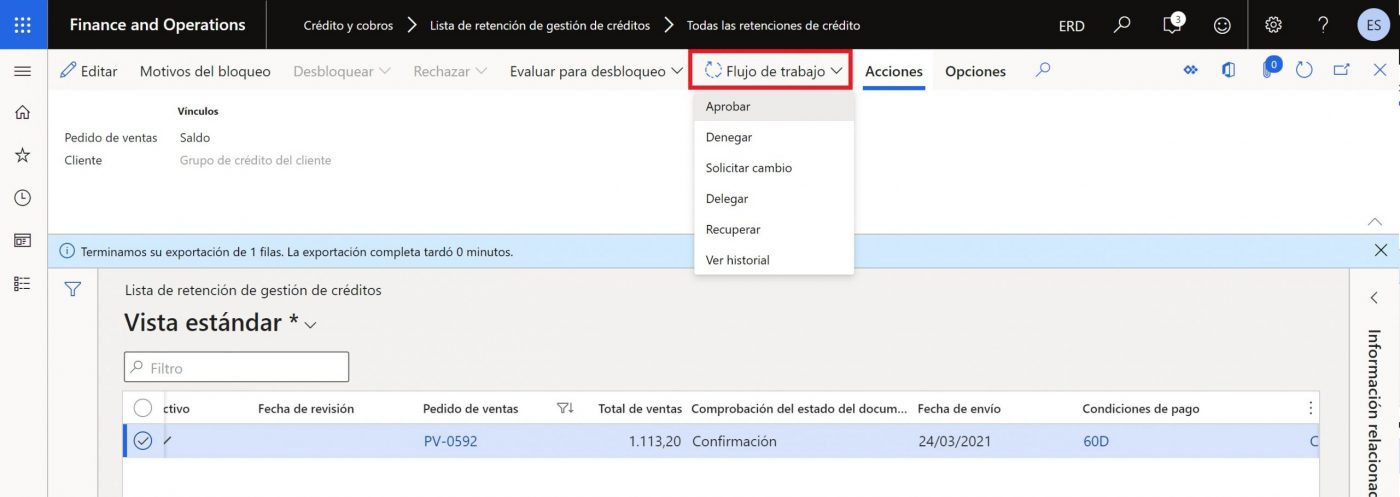

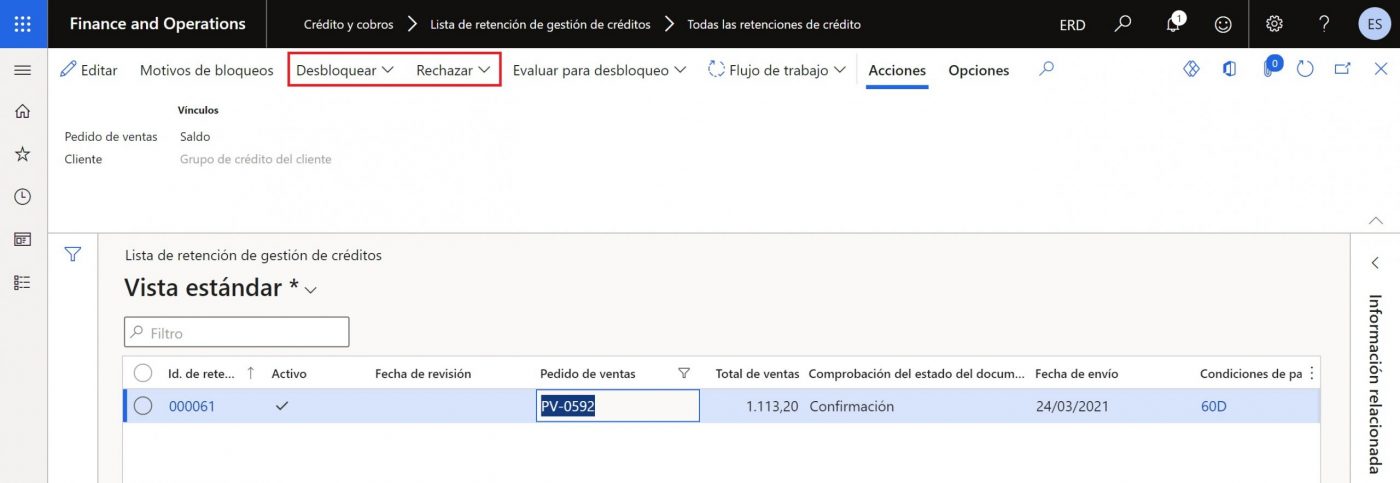

From the order itself, through the button Credit management > Credit management retention list, or from Credit and collections > Credit management retention list, you can consult the retained orders, the status in which they have been checked, the reason for blocking, as the screen is very large, as an example, I put in the following table, the data that would interest us most at this moment:

Sales order: PV-0592

Total sales: 1.113,20

Document status: Confirmation

Shipment date: 24/03/2021

Payment terms: 60D

Customer account: CLI-0019

Reason for withholding credit: Plazos de pago aumentados

At this point and depending on the permissions of each user, the order could be unblocked, but to make it more realistic, we have created a workflow for approval, like this:

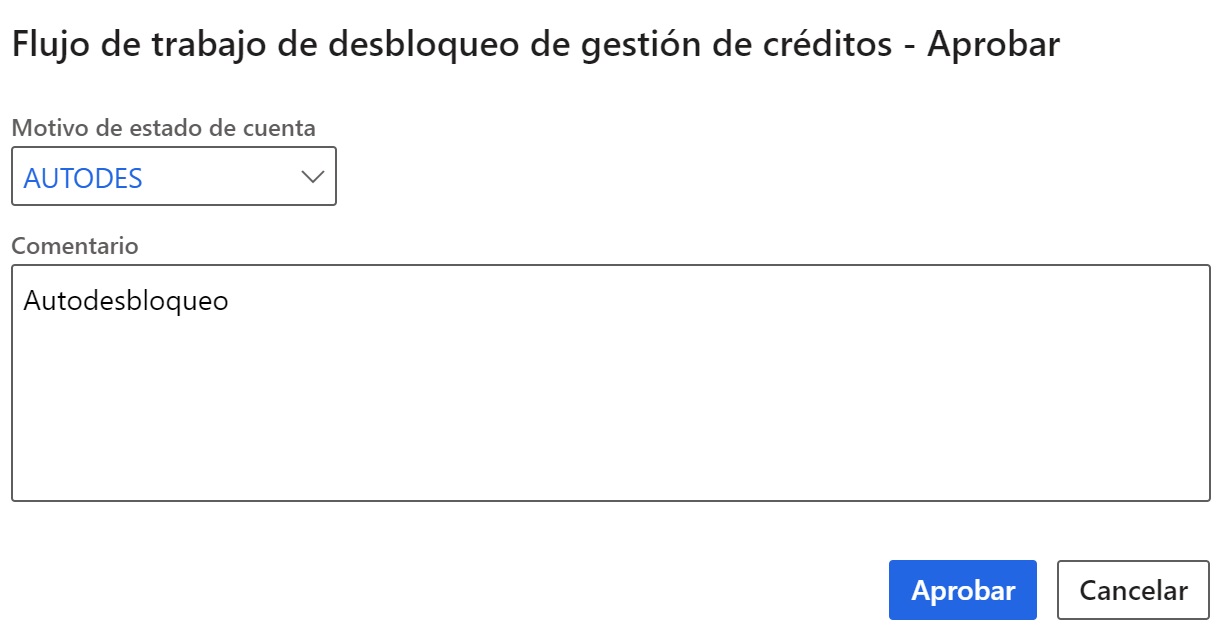

1. Click Workflow > Approve

2. Select an account statement reason and put a comment

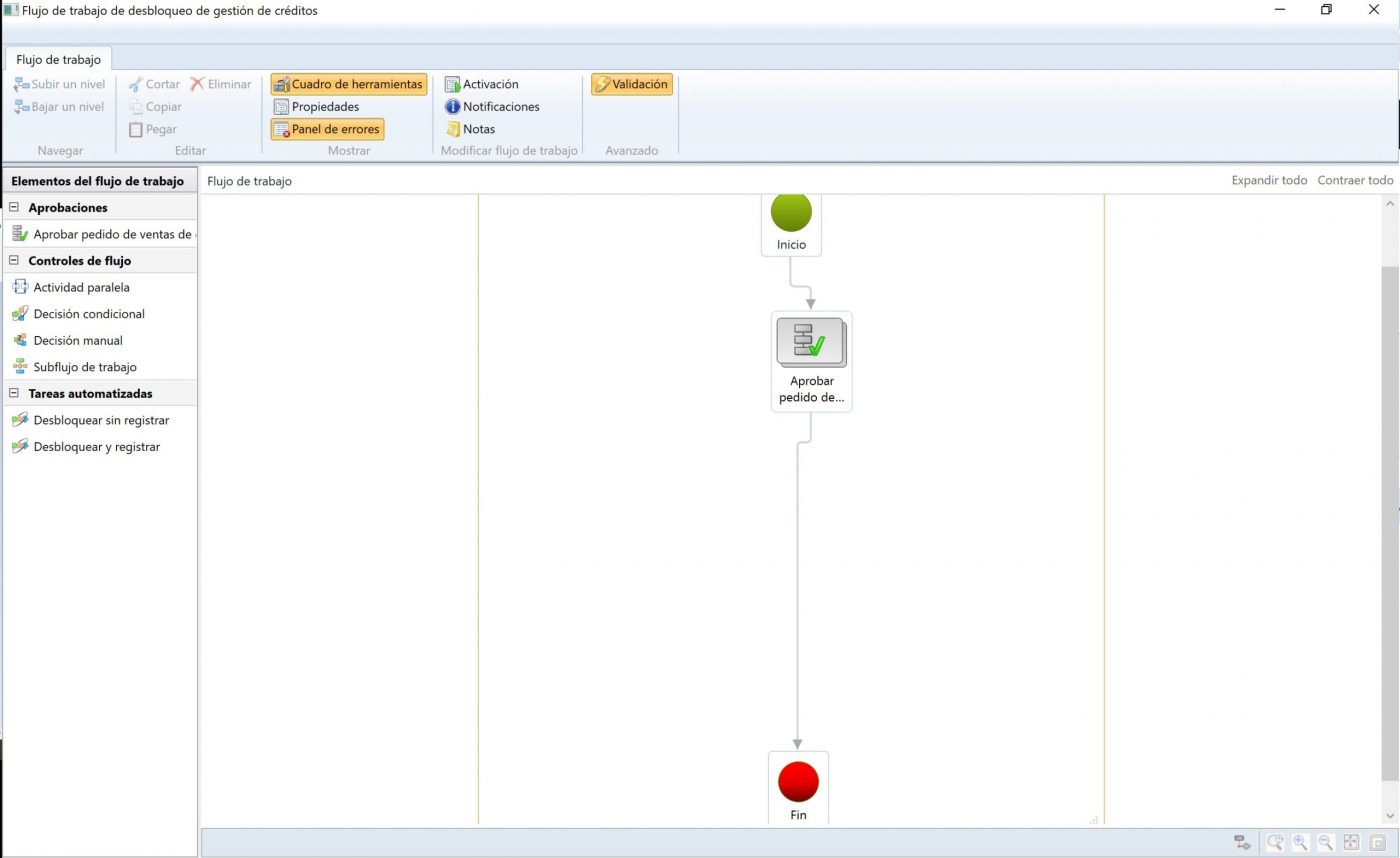

The flow created for this example is very simple, just an automatic approval:

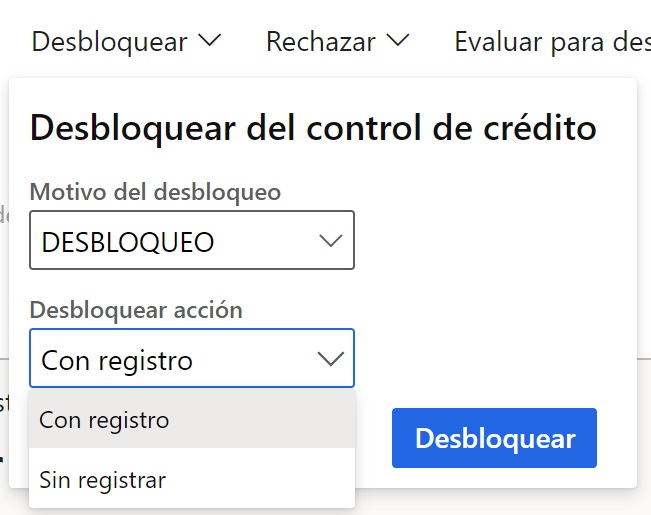

And once the workflow is approved, the “Unlock” and “Reject” buttons are activated

In the “Unblock” option, you will have to indicate the reason for unblocking and the action, which can be:With registration: it will register the action that we left pending, in our case, it

• Will open the sales order confirmation formWithout registering: it will approve the order, but

• Will not generate anything else.

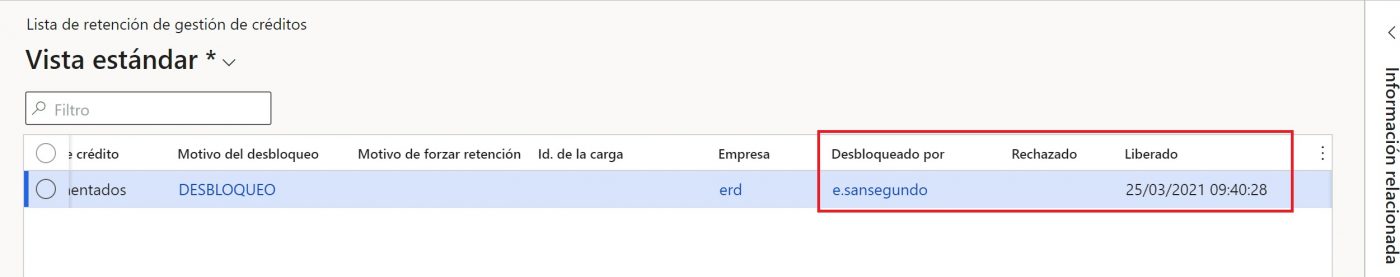

This process will also leave traceability with the user who has unlocked it and the date of unlocking (ditto if it is rejected).

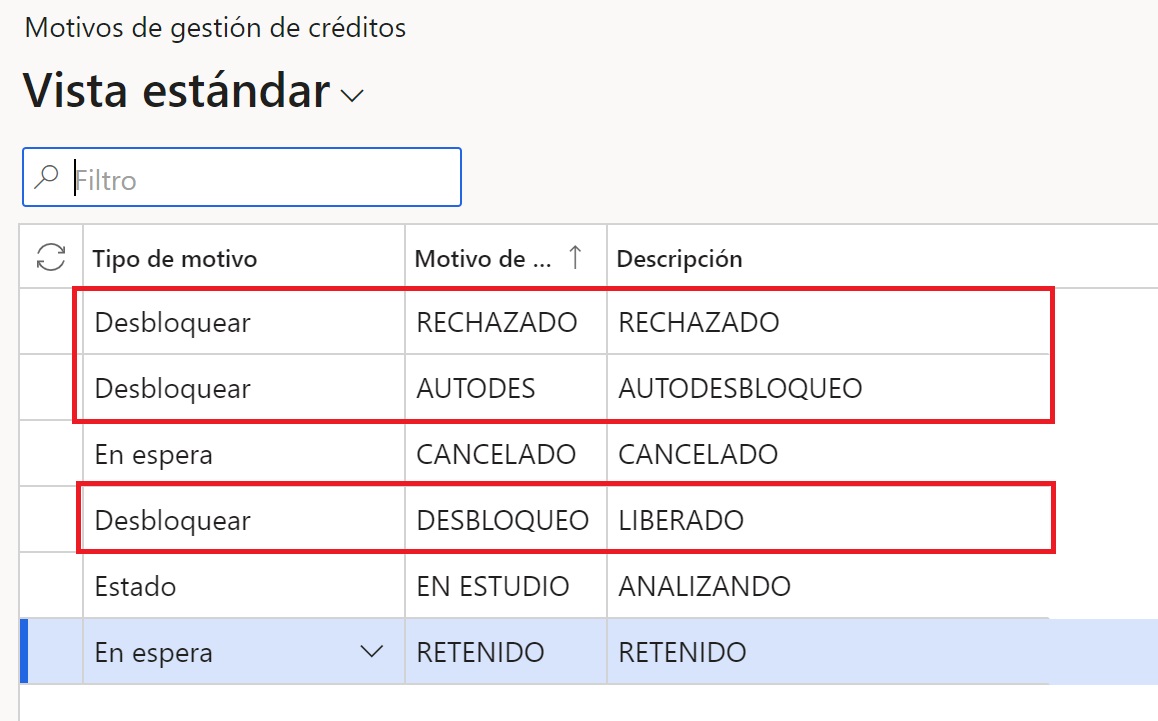

As a curiosity, the reasons for unblocking are configured from Credit and collections > Configure > Credit management configuration > Credit management reasons, the reasons that we have available, both for unblocking and for rejection, are those that have the reason type “Unblock”, this is somewhat strange, as we are going to use the same type of reason, both for unblocking and rejecting.

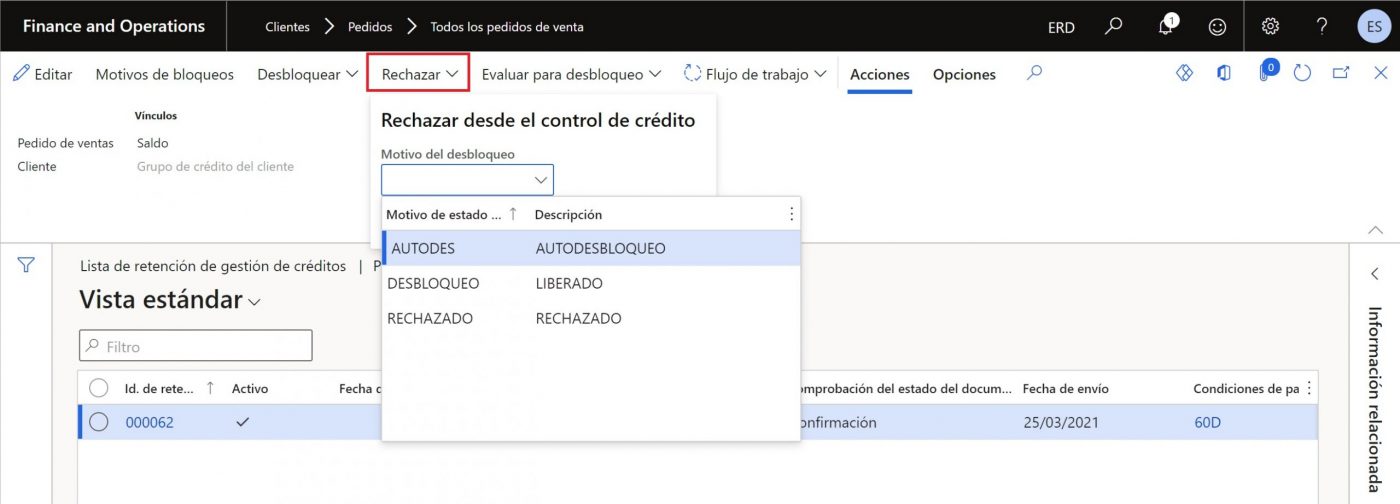

In this case, we are going to assume that a change is requested in the approval flow, therefore it has to be rejected:

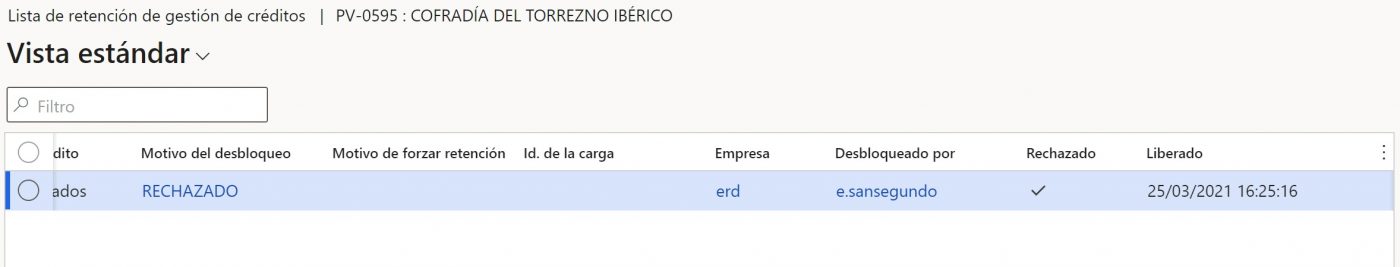

As information, it shows that it has been rejected, marking a tick.

At this point, I would leave the order unblocked to make the corresponding modification and when confirming, I would go through the credit management process again, to see if it meets the requirements.

I hope this information has been useful, it would work in the same way for discounts for prompt payment, we will see in the second part, the 7 remaining blocking rules.

Conclusions

The most immediate conclusion is the step forward in an area where D365FO had great potential for growth. The blocking rules broaden the conditions, which historically only took into account the amount of sales, to cover a wider set of cases.