If you’ve heard of the IEPNR acronym, it’s because you may have already read about the new environmental tax, which applies to manufactured products containing non-reusable plastic and to purchases of non-reusable plastic within the European Union.

At Axazure, by making the most of the potential offered by the standard version of Dyn365FnO, we would like to share with you the solution we have to help you manage the presentation of the settlement of non-recyclable plastic models.

What is the Special Tax on Non-Reusable Plastic Containers?

It is an environmental tax that levies items containing plastic that cannot be recycled, at a rate of €0.45 per kilogram of non-reusable plastic.

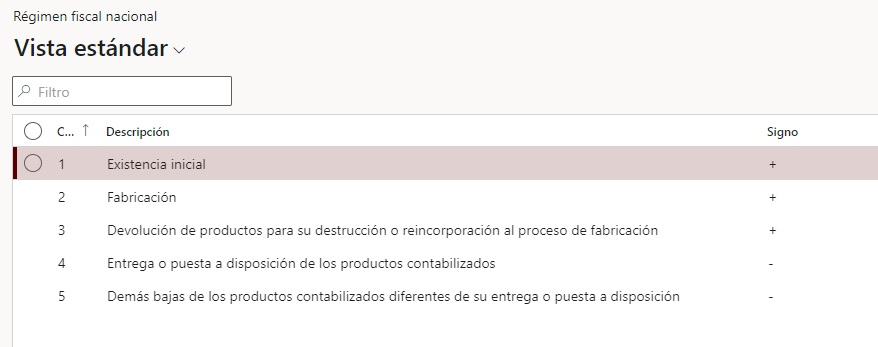

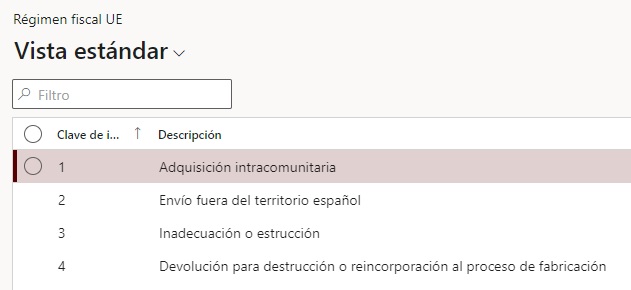

Companies that manufacture items falling under the scope of the tax, as established in Article 68 of Law 11/1997, will be required to present an inventory book, which is called the “Manufacturers’ Accounting” (Article 82 of Law 7/2022). In the case of purchasing non-reusable plastic within the European Union, the “Inventory Book of Intracommunity Acquirers” (Article 82 of Law 7/2022) must be presented.

How can it be managed within Dyn365FnO??

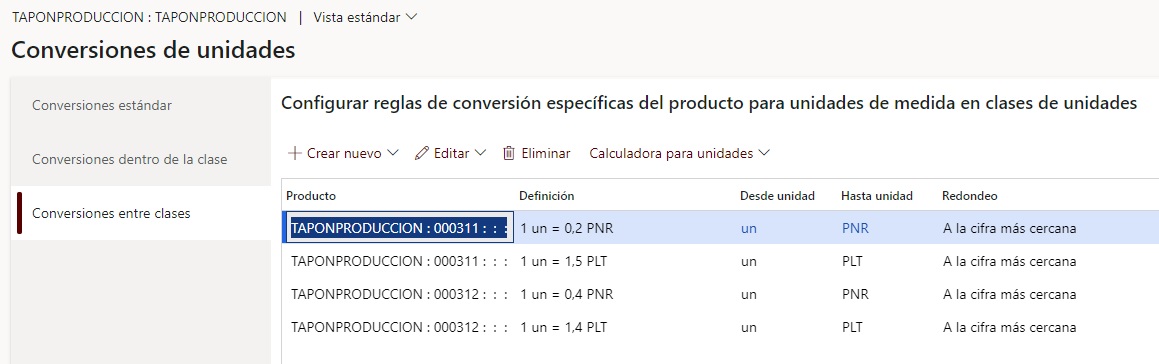

The standard functionality of packaging does not cover all requirements (Does not allow for complete traceability of the amount of plastic in purchases and manufacturing orders), which is why by converting units to total plastic weight (PLT) and non-reusable plastic weight (PNR), the quantity to be reported to AEAT can be obtained.

This unit conversion is fixed for a specific product or product version and will only change if its components are modified. When this happens, its bill of materials version should also change. In this case, we recommend using product versions to maintain precise inventory control, as two versions of the same product may coexist in our warehouse and we need to track the amount of plastic for each version. Of course, another way to do this would be to create a new product and replace the old one.

This way, inventory traceability can be managed from the purchase of raw materials to the sale of finished products, including manufacturing orders.

What is achieved with this?

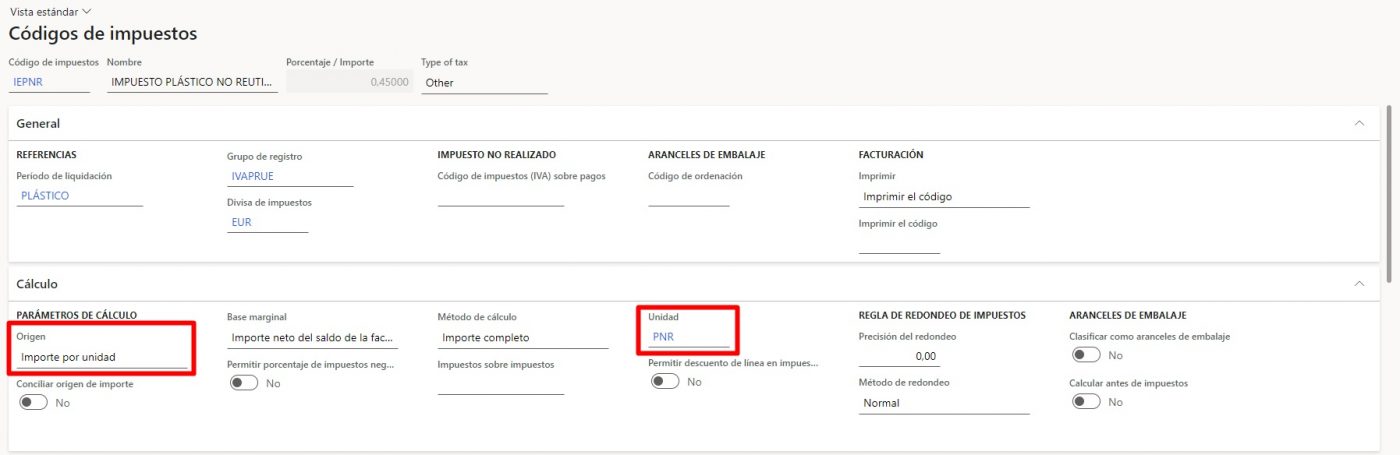

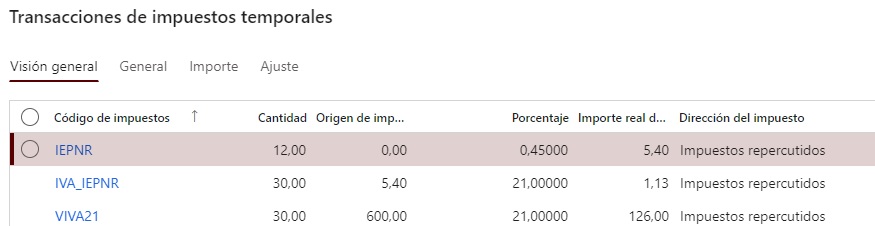

1.Well, on the one hand, it allows for the management of the tax generation, completely in a standard way, in which the taxable base of the non-reusable plastic tax (IEPNR) will be exactly the kilograms of non-reusable plastic, for which it is configured so that the origin is the amount per unit of kilos of non-reusable plastic.

Up until now, only the standard functionality of Dynamics 365 Finance and Operations has been used, and the need to generate the tax in invoicing would be covered. Of course, invoice formats would need to be modified if necessary.

2. The last step is the one that requires us to carry out a development, since through the conversion, we need to generate the necessary queries to track and control the stock, both in the original unit and its counterpart in PLT and PNR. And finally, using the data we have generated, we can issue the required books by AEAT (and in the future, even call different web services).

If you have any questions regarding the management and settlement of the Special Tax on Non-Reusable Plastic Packaging, do not hesitate to contact us.